What Causes Mortgage Rates To Rise And Fall?

What Factors Affect Mortgage Rates?

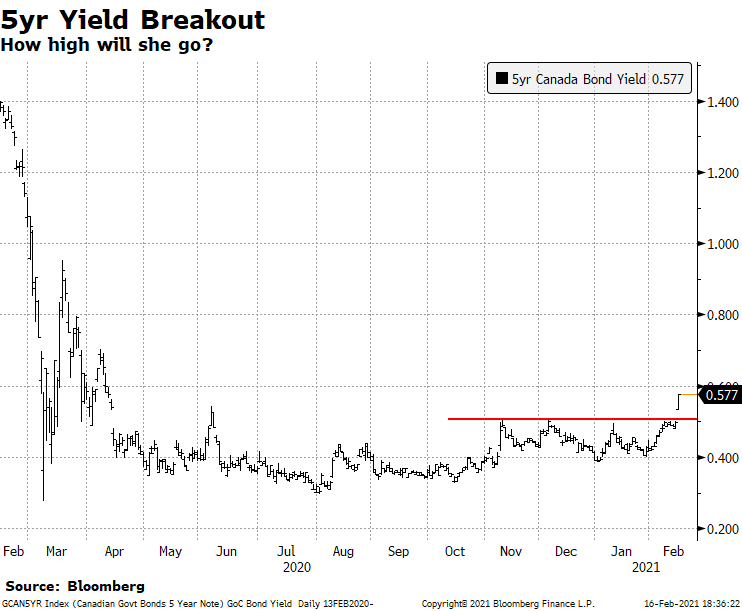

You may have heard in recent news that mortgage rates might be going up. Despite the economic effects due to COVID-19 that many Canadians have been feeling over the past 11 months in both small town and major cities like Toronto, the 5-year bond yield has started to rise, along with other economic factors that influence mortgage rates.

Fortunately, this is a sign that the economy is starting to recover, however this is also an indicator of the direction in which mortgage interest rates are headed. For the past 10+ months, we've been able to enjoy some of the lowest fixed rates and lowest variable rates in Canadian history, but it looks like that's about to start changing.

In fact, several mortgage lenders have already increased their rates over the past few days, and although somewhat counterintuitive to the way the COVID pandemic is going, this trend is likely to continue over the next several months.

One of the reasons that bond yield are increasing is because of government debts across Canada and the U.S. has grown substantially since the start of this pandemic. As the governments have been increasing the yields of their bonds in order to raise more money from investors to pay down some of the debt. Another reason is that traders are predicting that the economy will be significantly better in 2022 than it was in 2020 and even still is in 2021.

Although rates are not expected to grow astronomically, they already have grown by anywhere from 0.05% to 0.20% with certain lenders in the last few days. There are still a lot of variables that can change this rate of interest rate growth back into a downward direction over the next few months, but for the time being things look like they'll be headed up for the foreseeable future.

The Bank Of Canada Predicts No Rate Increase Until 2023? Doesn't That Mean Mortgage Rates Will Remain The Same?

No. In fact, the Bank of Canada's kew overnight rate has more of a direct impact on variable rate mortgage, where fixed mortgage rates are more directly dictated by the bond market and bond yield trends. This usually means that when bond yields go up, so do the rates on a fixed rate mortgage. When bond yield decrease, this tends to result in lower fixed rates.

How Can I Secure A Low Rate And Avoid Being Affected By Future Increases?

With only a few lenders who are still keeping their rates at the record lows, now is the best time to secure your mortgage at the current all time low rates. While many lenders have increased rates by up to 0.20%, we still have some lenders offering the following low rates as of the day this blog was posted and may change at any time:

- 1.35% for a 5-year variable rate on an insured purchase

- 1.49% for a 5-year fixed rate on a purchase insured mortgage

- 1.69% for a 5-year fixed rate on an insurable purchase

- 1.79% for a 5-year fixed uninsured mortgage for a purchase or refinance

To better understand the difference of an insured mortgage, insurable mortgage, or uninsurable mortgage read our blog post that details the difference between the three and the qualification criteria for each one:

Do I Have To Pay A Penalty To Break My CurrentMortgage?

That depends on a few things, such as how long you have left on your current mortgage, and whether your mortgage is open or closed, or variable rate or fixed rate, and who your current lender is.

It's important to note that depending on your current mortgage rate and terms, refinancing your existing mortgage now despite of the potential breaking penalty might save you thousands of dollars or more in the long run.

If you have a variable rate mortgage, the penalty to break it would generally be only 3 months of interest payments. With a fixed rate mortgage, the mortgage prepayment penalty will typically be the great of either 3 months of interest payments or the interest differential (IRD). Depending on how high your current mortgage is and how little time you may have left on your current mortgage term, by breaking it now and rolling your penalty into the new mortgage refinance (increase the new mortgage amount to cover the penalty), you might be saving thousands or tens of thousands of dollar on your interest costs over the course of your mortgage.

To better understand the potential mortgage prepayment penalties and the difference between IRD (interest differential) vs 3 months of interest, you can read our blog post that compares the pros and cons of a variable rate mortgage vs a fixed rate mortgage:

If you're either buying a home, already bought a home and in need of a new mortgage, or currently own a home with an existing mortgage, now is the best time to call Clover Mortgage at 416-674-6222 or email us at info@clovermortgage.ca to speak with one of our expert mortgage brokers to see what great low rate you can qualify for before rates increase even more.