FOMO In Real Estate

From other social media, impulse purchasing, and other facets of society, the real estate industry has now fully welcomed FOMO and its lingering effects. Home purchases have experienced significant behavioral changes due to the widespread pressure for people to acquire properties before both market prices increase more and the seller claims the desired house. Real estate FOMO leads people to make quick choices by exceeding buying offers above listing prices along with declining inspection procedures which can prove disadvantageous for enduring property value.

Understanding how emotions impact customer choices in real estate has never been more crucial during times when housing costs rise and fall. The current housing market features FOMO as an active force that affects property values alongside consumer psychology along with strategies needed for grounded buying decisions.

How FOMO Influences Buyer Behavior

FOMO in the housing market occurs due to the belief that delay will deprive them of homeownership forever. FOMO occurs at its worst when seller markets are prevalent and supply is equal to the amount of competitive aggressive demand. The houses vanish from the market very rapidly while houses find buyers within days leading to competitive bidding. Buyers in such market conditions are forced to push their price limit by abandoning critical evaluation procedures while placing desperate offers beyond their means. Some of the effects of FOMO on buyer behavior are:

- Impulsive decision-making: Rushed consumers motivated by FOMO ultimately make emotional rather than logical decisions. FOMO leads consumers to skip crucial stages of analysis that involve comparing properties as well as long-term property research and in-depth real estate analysis.

- Overpaying: Bidding wars compel purchasers to overpay above market price just to acquire the deal. Entrepreneurial risks in emotionally motivated buying decisions often lead to financial difficulties in the future especially in the case of market fluctuations or interest rate changes.

- Insufficient due diligence: Certain buyers create more bidding leverage by not having property inspections and financing contingencies in their bids. Arriving at competitive offers with these strategies can leave you with more surprises later on in the negotiation process.

Case Study: When FOMO Takes Over

Amanda began her Vancouver first-time homebuying search in 2021 as she started exploring house options. With the increasing home prices that her friends achieved and their successful home purchases, Amanda experienced mounting pressure in her search. Uncertainty about a townhome purchase drove her to buy a property at $735,000 despite her planned $650,000 budget collapse through multiple lost property acquisitions. She chose to skip the inspection process since this increase made her proposal more appealing to sellers.

A single year was sufficient for the market temperatures to decrease. Her real estate property lost value down to $675,000 and mortgage rate increases eliminated any possibility of payment flexibility. Throughout her recollection, Amanda understood her previous buy was motivated by frightened impulses instead of strategic preparation which FOMO typically induces.

Market Impact: What Happens When FOMO Drives Demand

Demand undergoes unnatural shifts because buyers make purchasing decisions through fear rather than market fundamentals.

According to Steven Tulman, President of Clover Mortgage and principal broker :

“ The market attracts increased competition as numerous people rush in despite lacking financial readiness. The large demand spike drives home prices to exceed property values which leads sellers to raise their offering prices while homes speed through the market.”

To highlight the contrast between a FOMO-driven market and a more balanced one, consider the following comparison:

| Feature | FOMO Market | Stable Market |

|---|---|---|

| Buyer Behavior | Emotion-driven, urgency to act | Thoughtful, research-focused |

| Property Prices | Often above market value | Closer to the appraised value |

| Time on Market | 1 - 5 days | 2-4 weeks |

| Inspections and Conditions | Often waived | Commonly included |

| Seller Leverage | High - multiple offers | Moderate to balanced |

| Buyer Satisfaction (long-term) | Lower due to regret or financial stress | Generally higher, more considerate purchases |

Avoiding FOMO: What Buyers Can Do

The real feeling of fear about missing out exists but does not need to control what you purchase. Even in this fast-paced market homebuyers can follow certain steps to stay mentally stable. Here are some steps you can take to avoid FOMO as a buyer:

- Budgeting: The first step should involve creating a budget that matches your current financial capacity instead of accepting any approved amount from lenders. Your budget needs to include an appreciation of interest rate surges alongside maintenance costs together with an added safety margin.

- Picking The Right Real Estate Agent: Your home search search requires a real estate agent who focuses on lasting property value rather than immediate deals. The right real estate advisor helps homebuyers make objective house evaluations, as they protect them from market competition and answer your questions .

- Make A Checklist: Create a checklist that specifies your absolute needs for a home together with the bargaining areas and the requirements you cannot change. Throughout the emotional house-hunting process, you rely on checklists to fall back on your essential criteria.

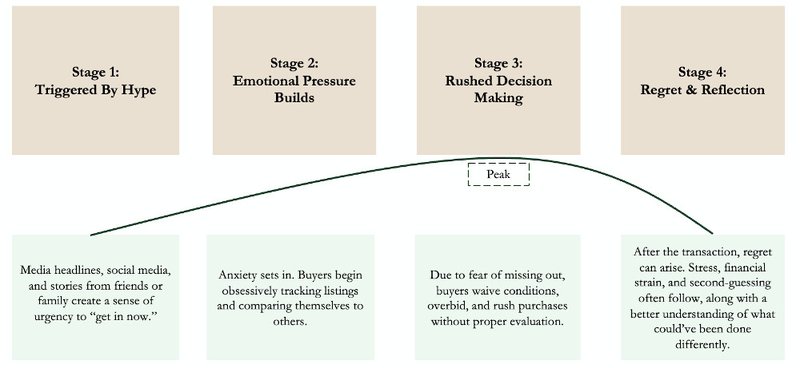

Flowchart: The FOMO Decision Spiral

To better understand how buyers fall into the FOMO trap, it helps to map out the typical emotional journey. Here’s a breakdown of the stages:

Conclusion

The effect of real estate FOMO remains strong, however, it sometimes produces unproductive outcomes. The lack of clear thinking brought on by urgent situations often drives customers toward homes that they cannot pay for effectively or do not prefer at all. Quick decisions in hot markets do not require people to abandon smart planning processes. By following the appropriate buying strategies and securing the necessary support with the proper mindset, buyers can move smoothly through competitive market conditions without allowing fear to drive their decisions.

Contact us at Clover Mortgage to seek the best guidance to avoid FOMO in the real estate market and find your dream property.

FAQs

How does FOMO affect home buyers in a hot real estate market?

The experience of FOMO generates a sense of emergency that compels potential buyers to make choices from a position of panic. Some homebuyers sacrifice property inspections pay excessive prices or choose unideal homes just to prevent sensing they fall behind others.

Is FOMO a driving factor behind overpaying for properties?

Yes. People who suffer from FOMO submit inflated offers higher than actual property value just to obtain ownership of the property. Market prices of properties exceed their reasonable value due to this effect which results in rising housing markets during certain periods.

What strategies can homebuyers use to avoid making rash decisions due to FOMO?

Budget realistically and work alongside an honest agent to manage priority items which will lead to successful home acquisition. Homebuyers should avoid skipping any standard inspections together with financing assessments. Take regular pauses to prevent burnout while maintaining your real market assessments.

How does FOMO impact property prices and demand in real estate markets?

The emotional urges of persons with FOMO boost real estate demand which raises property values through excess competitive bidding. Education contributes to bidding wars in the market which shortens residence sale times and establishes an ongoing vendor expectation of rising bids.