How do US Tariffs Affect the Real Estate Market in Canada?

Real estate in Canada has reached its most crucial point. 2025 brought about U.S. tariffs that established an external disruption to the market at large. The recently enacted tariffs have modified material expenditures while simultaneously extending construction durations and prompting doubt across development figures and property investors and buyers.

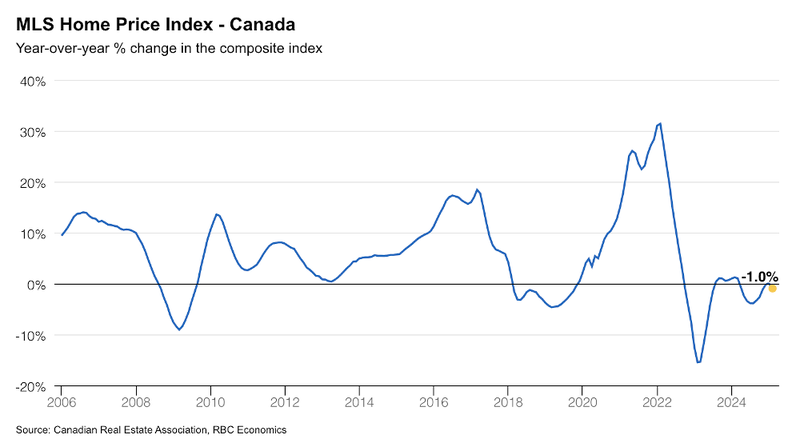

The Canadian housing affordability pattern has historically been determined by demand-supply imbalances combined with monetary policies, but trade-related changes now add market instability to residential development initiatives alongside existing resale property patterns. In short, how do the US-Canada tariffs affect the real estate market?

A Trade War with Housing Implications

Canada's economic situation remains closely connected with the United States because the U.S. serves as its primary trading partner as well as its main supplier of imported goods, together with materials and capital. Exports from Canada cross the southern border to reach the United States at a rate of 75%, which leaves the country exposed to any adjustments in U.S. commercial policy, especially tariffs.

Fast economic growth has come to a standstill while interest rates remain elevated, and consumer confidence is weak, so any interruption in cross-border trade will rapidly impact housing production along with manufacturing and employment numbers. The dependence of Canadian real estate on American-making building materials and foreign investor sentiment regarding macroeconomic performance leaves Canadian real estate vulnerable within this period. The U.S. Trade Office declared new tariffs that reached a maximum level of 25% on essential construction materials from Canada, including dimensional lumber and fabricated steel, as well as PVC piping, upon implementation in March 2025.

On a similar note, Canada experienced a 9.8% drop in home sales in February 2025, which marked the biggest decline since 2019. Development firms reacted instantly by putting new building activities on hold and reducing spending plans, and sent delayed construction timelines to their investors. The recovery momentum of pre-construction housing since the 2022-2023 interest rate increases faces new challenges. Home purchasers refrain from making deposits due to building delays and projected price increases.

The structural changes impact the building sector more than short-term fluctuations. American trade taxes generate higher input prices throughout the housing production framework, from construction wood to unit heating and ventilating equipment, which developers either transfer to house purchasers or maintain themselves, thus diminishing incentives to construct or purchase properties.

April 2025 Housing Market Snapshot

| Region | Resales YoY | HPI (Home Price Index) YoY | SNLR (Sales-to-New-Listings Ratio) |

|---|---|---|---|

| Canada | -10% | -2% | 45% |

| Toronto | -23% | -4% | 50% |

| Montreal | 5% | 6% | 60% |

| Vancouver | -12% | -3% | 35% |

| Calgary | -15% | 2% | 55% |

| Ottawa | -5% | 0% | 50% |

Ontario and B.C.: What Are The Impacts?

The two largest provincial markets in Canada, represented by Ontario and British Columbia, experience acute risks from their heavy dependence on imported building materials, while housing affordability has remained limited throughout history.

Residential house sales decreased by 29% throughout the Greater Toronto Area between January and February 2025. A rapid downward adjustment in the market results from three converging factors: increased development expenses combined with elevated interest rates as well as construction uncertainties brought about by trade tariffs. The proportion of building components in GTA development comes primarily from U.S. suppliers, with lumber and glass being the main materials, and many developers are postponing site launch plans until prices become stable.

The MLS Home Price Index in Vancouver fell by 0.6% throughout February as residential properties remained accessible in the market. Buyer fatigue surges due to uncertain prices and not due to uninterested buyers. Buyer power is regaining strength through declining price wars and increasing vendor price cuts as macroeconomic situations remain volatile.

Parallel with the Pandemic

The impact of US tariffs on the Canadian housing market draws similar parallels to the COVID-19 pandemic. The early phase of the pandemic created broken global supply networks, which produced large-scale housing market unpredictability. A fundamental distinction exists between these responses because of money.

During 2020 the Bank of Canada hit an all-time low with their overnight interest rates that caused an immediate upgrade in mortgage activity and quickened home price appreciation patterns. Cheap capital supplied the foundation for market expansion during the times of pandemic.

By 2025 the worldwide conditions display substantial changes. Current mortgage interest rates show minimal decline as they stay elevated to a mean 5.80% according to variable rate records and RBC detects no meaningful reduction. The current economic situation acts as a risk amplifier rather than creating incentives for home purchasing because the U.S. tariffs do not have government relief programs or mortgage payment delay programs. The latest economic shock derives from fiscal factors that lead to an immobilizing effect instead of financial volatility.

The high capital costs continue to burden developers in addition to their escalating construction expenses. The annual rates for fixed and variable mortgages are expected to range from 4.5% to 5.5% throughout the remaining period of 2022. The lockdown's dual impact on both sides of the market creates a full market freeze effect.

Reassessing the Outlook

In September 2024 , I predicted a cautious, optimistic forecast about the Canadian housing market for the next five years while issuing my outlook. I predicted that Canada would experience a regular home price and sales recovery during the gradual economic recovery phase and interest rate reduction. In addition, Urban condo demand would gradually return to the market because consumers would rebuild trust in real estate as affordability conditions improved.

Given the US tariffs, I had to reassess my short-term outlook due to the U.S. tariffs on Canadian materials that were implemented in March 2025.

I did not expect the tariffs to negatively impact consumer sentiment to this extent. National home resale decreased 10% in February 2025, at the same time Toronto house sales dropped 29% and Vancouver rates declined by 13%. Such dramatic market shifts illustrate the weak nature of consumer psychology together with the strong ability of external events to bypass critical drivers such as immigration needs and interest rates.

The long-term housing market conditions appear favorable in areas which have minimal dependence on United States imports. Saskatchewan together with Alberta maintain robust real estate activity while dealing with minimal cost increases. The small condo units located in dense downtown areas have potential price growth if constraints in new supply continue but this opportunity exists only in specific markets with stable demographics.

So, is my original forecast still intact? Technically, yes. This recovery process has become longer, and recovery speeds will decrease in the provinces most affected by the tariffs. Future conditions will influence supply-demand performance through a combination of rate cuts and the speed of tariff resolution, along with tariff price adjustments. The market demands active analysis from participants who need to pay attention to regional data indicators.

Where Can Canadians Stay Protected?

The housing corrections caused by tariffs affect Ontario and British Columbia strongly, but other Canadian areas have protection from this impact. The location of Alberta and Saskatchewan affords property protection because their building costs are lower, and they offer resilient marketplace demand and diversified material supply networks.

The resale market in Calgary and Edmonton currently maintains pricing better than previous pandemic stats. The market fundamentals demonstrate restricted supply and demand relationships as end-users replace speculative buyers thus leading to stabilized prices. The population inflow from Ontario and B.C. to Saskatoon leads to growing housing market activity because buyers seek cheaper options.

These provinces present homebuying possibilities to people who want to enter homeownership while avoiding fluctuations commonly found in major cities. Homeowners in Ontario along with B.C. must focus on managing their refinancing risk while obtaining lasting fixed rate mortgages before possible rate increases occur.

Conclusion

The housing market stands at an important moment brought about by our American counterparts and their tariffs. Canadian housing fundamentals maintain stability in the long run, but short-term market disruptions will continue until trade relations stabilize. The real estate market, amid US tariffs, now demands adjustments from home buyers, together with property sellers and developers, since geopolitical forces merge with interest rates to transform market conditions.

To best navigate the current high-risk environment, contact us today at Clover Mortgage to strategize against macroeconomic headwinds from tariffs and other events. Market resilience will face extreme tests during the following six months, but those who seek expert advice will experience the best risk-adjusted outcome.

FAQs

Will US tariffs affect Canadian real estate?

Yes. The application of tariffs results in increasing material expenses and postponements in house building activities affecting pre-construction housing development as well as existing home sales. The market instability has triggered a major drop in resale numbers and new listing availability particularly in the Ontario territory.

How will tariffs affect the housing market?

The tariffs will increase construction materials prices, resulting in many housing development projects becoming less profitable. Therefore, developers will hesitate to build, and builders will have fewer options to sell. The decreased consumer activity results in falling prices and distress among sellers in areas affected by excessive leverage. The duration of tariffs will determine the extent of market disruption that builds into the market.