How Long Does Bad Credit Stay On Your Record?

How Long Does Bad Credit Stay On Your Record?

Everyone makes mistakes. When it comes to your credit score, once a mistake is made, such as a late or missed payment on your credit card, it can take a long time to have that mistake erased from your credit report, but how long does it take for these mistakes to get removed from your credit report?

Let’s say that your credit score has been negatively affected, but you have a plan to resolve and pay off your outstanding debts. How long will it take for your credit score to improve enough so that you can qualify for a mortgage and other loans?

There are two main credit reporting bureaus in Canada, Equifax and TransUnion. Different lenders will rely on one and sometimes even both credit reporting bureaus to determine if you are a good candidate for a loan or mortgage, and what rates and terms you might be able to qualify for. Each of these two credit agencies keep different credit information on file for different lengths of time.

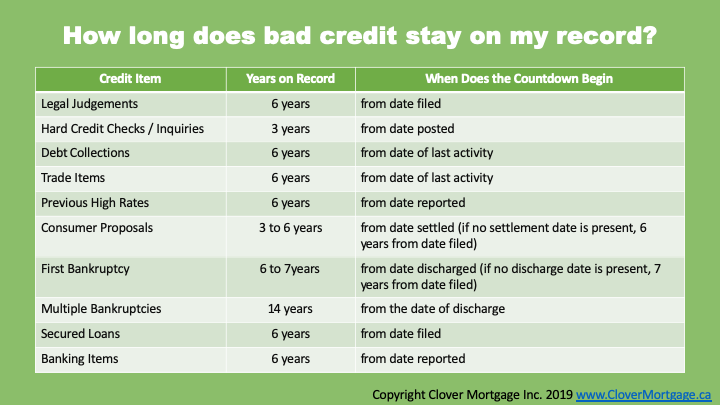

Here is a simplified chart that illustrates how long the two main credit bureaus keep bad credit details on your file.

Information That Affects Your Credit Record

Revolving Credit Transactions

Information about your revolving credit transactions is reported on a variety of credit sources including credit card accounts, lines of credit, and more.

While Equifax will likely keep negative information about your revolving credit account on record for up to 6 years form the date of your last payment, TransUnion will usually keep this information on your file for up to six years from the date that it was first reported as being delinquent.

Debt Collection

Once bad debt is sent to a collections agency, this tends to remain on your credit record for 6 years. With Equifax the six years begin as of the day that the debt is first assigned to a collections agent, whereas TransUnion starts counting from the date when your account first became past-due with the lender.

Secured Loans

A secured loan is a loan that is backed by an asset such as a property in the case of a mortgage , or a vehicle in the case of a car lease or car finance.

Equifax will usually keep negative information about secured loans on your record for a period of 7 years to 10 years from the date of filing, while TransUnion will generally keep this information on your file for seven years to ten years from the date of first delinquency.

Legal Judgements

Legal judgements come in the form of bad debt that you owe as a result of losing a lawsuit. This information usually stays on your credit record for up to 6 years from the date of filing, although this may vary from province to province based on their local reporting standards.

If you live in Ontario, New Brunswick, Newfoundland and Labrador and Quebec, TransUnion usually retains legal judgements on your credit report file for seven years. For those who live in P.E.I., TransUnion will likely retain this information for up to ten years. Equifax tends to keep this information for 7 to 10 years. More information is available about this in the detailed fine print of your credit bureau report.

Bank Accounts

Negative information about your bank accounts, for example when a chequing account or savings account has been closed by the bank due to fraud, will stay on your credit report for up to 6 years. Equifax starts the six years countdown as of the date of transaction or default, whereas TransUnion will start their count of six years from the most recent of either the date that the bank wrote off the bad debt or closed your account.

Registered Items And Debts

When it comes to items debts that are registered with the credit bureau, such as a lien against your property, this information will often stay on your record for up to ten years. This can vary from province to province.

TransUnion can keep this information listed on your credit file for up to 5 years from the date of filing, while Equifax will keep these registered items on your record for 6 years unless you live in Prince Edward Island. In Prince Edward Island, Equifax keeps this information on your file for up to ten years.

Consumer Proposals

In essence, a consumer proposal occurs when a borrower or an agent representing the borrower negotiates a reduced amount that the borrower needs to pay back to a creditor to bring their debts up to date. This is a legally binding agreement between a borrower and a creditor that is owed money for an overdue debt. The purpose of a consumer proposal agreement is to legally outline a newly negotiated amount and the terms that this amount will be paid back. Essentially, the creditor will forgive a portion of the debt to enable the borrower to pay back a smaller manageable and realistic amount.

Both Equifax and TransUnion will keep a consumer proposal on your record for either 3 years after the newly agreed amount has been paid off of up to 6 years after the consumer proposal is signed and takes effect, whichever comes first.

Bankruptcy

If you have ever filed for bankruptcy, it will typically stay on your credit report for a minimum of 6 years from your bankruptcy discharge date (if you only have 1 bankruptcy).

While TransUnion has no limit to how long it can keep your bankruptcy on your credit record, it will usually purge it from your record 7 years after you are discharged from bankruptcy. This can vary from province to province.

Equifax, on the other hand, can only keep your first bankruptcy on your credit record for up to a maximum of 7 years from the date of filing.

If you experience more than 1 bankruptcy the information will remain on your record for 14 years from the date of discharge for each bankruptcy. Many traditional lending institutions such as some banks will not be willing to consider a borrower who has had 2 or more bankruptcies in their lifetime for a mortgage. Fortunately, our experienced mortgage brokers at Clover Mortgage work with many lenders who would still be willing to approve you for a mortgage.

Credit Inquiries

One thing that many Canadians do not know is that everytime a bank or creditor pulls your credit report and makes an inquiry into your credit bureau file, this inquiry stays on your credit report and can negatively affect your credit score? That’s right, the more “hard” inquiries you have into your credit bureau, the lower your score will be.

This information remains on your Equifax credit report for three years from the date the inquiry was made, and will remains on your TransUnion report for 6 years from the date the inquiry was made.

This is why we at Clover Mortgage recommend that you take a more strategic approach if you intend to apply for new credit. Even applying for a few credit cards or retail store credit cards in too short of a period of time can have a negative effect on your credit score.

Positive Information

Not all information stored on your credit record is bad. If you take the right steps and manage your credit carefully, you can be pleasantly surprised at how quickly your credit might improve. If you start using your credit in a positive way, by paying your bills and making your payments on time, and only carrying a maximum balance of 20% to 30% of your available credit limit, you can be on your way to credit recovery rather quickly.

A poor credit score can negatively affect your ability to get a mortgage , rent a place to live, apply for a job, get a cell phone plan, lease or finance a car, and much much more. This is why it is important to always be on top of your credit and if life circumstances put your into an unfavourable financial and credit situation, you might be better off taking out a small home equity loan to get caught up on overdue debts and start rebuilding your credit.

Both Equifax and TransUnion tend to hold positive credit information on your record for up to 10 years, so by displaying more positive habits, you can start to benefit from the advantages that a strong credit score can bring you.

Our team of knowledgeable and experienced mortgage brokers at Clover Mortgage can help you get on your way to rebuilding your credit and taking control of your financial situation.

Call or text us today at 416-674-6222 or toll free at 1-800-673-2230 , or email us at info@clovermortgage.ca to speak with a licenced and experienced mortgage broker and get your free no-obligation mortgage consultation.