How to Make the Most of Your Home Equity

What is Home Equity?

Home equity, by definition, represents how much of your home you actually own. For example, if you bought a $1 million home, put down a payment of $200,000, you would have $200,000 of equity in the home. If after a few years, the market value of your home had stayed consistent, and you had since paid off an additional $300,000 of your $800,000 mortgage, you would now have $500,000 of equity in your home. In other words, home equity is the difference between the value of your home, and how much money you still owe your mortgage lender (for the principal loan).

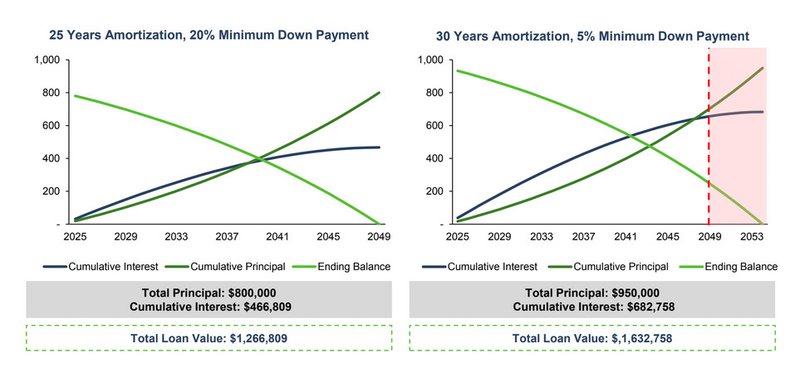

Not every dollar you spend on your mortgage goes towards building your equity. Your monthly mortgage payments are a mix of principal repayment and interest payments to your lender. Only the part of your payments that goes towards the principal counts towards building your home equity. Typically, you’ll pay more interest in your first few payments since your loan balance is higher, but as you get closer to the end of your loan, you’ll start building equity at a much faster pace (Figure 1).

(Figure 1): 25-year amortization of a $1 million home, assuming a 20% down payment

(in thousands, CAD)

What is Home Equity Financing?

Sometimes, your home equity can be used as collateral against other loans and help you consolidate your debt, or access cash when you need it most. There are a few different financing options that you can consider:

| Credit Limit | Interest Rate | How to Access $ | |

|---|---|---|---|

| Second Mortgage | 80% of your home’s appraised value minus any mortgage you still owe | Fixed / Variable | Lump-sum deposit |

| HELOC | 65% of your home’s appraised value | Variable | As needed (line of credit) |

| Reverse Mortgage | 55% of your home’s appraised value minus any mortgage you still owe | Fixed / Variable | Lump-sum deposit (or instalments) |

Second Mortgage

A second mortgage is a secondary loan you take out on your home. You can take out a loan worth up to 80% of your home’s value, minus any principal you still owe on your original mortgage loan. To determine the value of your home you can conduct an appraisal, and that appraised value will be what’s used to determine your loan limits. Typically, you’ll get the payout of a secondary mortgage as a lump sum deposit into your bank account (like with any other mortgage). Check out our page on secondary mortgages to learn more!

HELOC

HELOC stands for Home Equity Line Of Credit , and is another sort of equity financing you can consider. Unlike a second mortgage, a HELOC won’t give you a lump sum of money to use. It works more like a credit card, allowing you to borrow money as you need it. You can borrow up to 65% of your home’s appraised value, and the interest rate will almost always be variable. The exact specifics of your repayment schedule may differ from lender to lender, but our team of brokers can help connect you to the best options available to you.

Reverse Mortgages

A reverse mortgage is an equity loan available to Canadians over the age of 55. Most commonly used to unlock cash after retirement—once income slows, this loan allows you to access up to 55% of your home’s value. Unlike the other loan types mentioned in this section, a reverse mortgage will accumulate more interest than a HELOC or a second mortgage, but none of that interest needs to be paid back until the very end of the loan. Once you sell your home (or if the borrower passes away), all the principal and interest will be due at once in the form of a lump sum repayment.

How To Make Full Use of the Equity on a Home

Equity financing can serve different purposes for different homeowners. If you have racked up credit card debt or other loans, a home equity loan can help you consolidate multiple debts under (what is typically) a much smaller interest rate. If you are looking to retire in the near future, and want to access some of the cash tied up in your home, a reverse mortgage can be an excellent option. If you are going through a period of less certain income, having an HELOC can be a great way to supplement your savings. Whatever your needs, Clover Mortgage can help connect you to the best lenders for your unique situation.

“ Pulling from your home’s equity can also open doors to investment opportunities. You could buy a rental property, invest in stocks, diversify [your portfolio]…As long as you can generate more return than you’re losing out on through interest, it’s a great way to build long-term wealth.”

— Steven Tulman, President & Principal Broker

With a network of over 80 lenders, and experience working with each and every one of them, our Clover Mortgage brokers are well-equipped to help you determine if equity financing is a good choice for you, and if so, which broker would be best suited for your needs. We can also help you secure favourable rates and terms. To learn more, contact Clover Mortgage today to get started with a free consultation.

FAQ

What builds the most equity in a home?

Building equity can sometimes be as simple as letting your home’s value appraise over time. As the value of your home increases, the value of your total equity also increases. If home equity is calculated as the difference between the appraised value of a home, and the unpaid principal of your mortgage, then increasing the value of your home will increase your equity.

Paying down your principal is also a major contributor to the speed at which you build equity. Since home equity is only increased by principal payments and not by interest payments, choosing a shorter amortization period, or opting for a larger down payment can increase the rate at which you build equity over time.

What is the best way to access home equity?

The best way to access home equity will depend on your needs. A HELOC can be a great choice if you’re looking to cover more variable costs (renovations, landscaping, etc.). A reverse mortgage can be a great option if you’re over 55 and looking to avoid making regular repayments. By consulting your Clover Mortgage broker, you can also receive more personalized advice on which method of equity financing would be most appropriate for your situation and needs.

How do I free up equity in my house?

One method of freeing up equity is to obtain equity financing. This can include a home equity loan, a second or third mortgage, a HELOC, a reverse mortgage, etc. However, this is not the only method. For instance, you can refinance your home while simultaneously cashing out some of your equity. A refinance might also score you a better rate on your mortgage.

Selling your home is another great way to free up equity. While there will be a tax applied on any additional earnings after your lender is paid back, you can still make a profit in many cases—especially since home values have soared over the last decade. If you own a home with multiple units (that are legally zoned), you can also consider selling part of your house instead of the entire property.

Sources: